JJ Gold Net 30 Review: Net 30 Vendor To Build Business Credit

Author: Chandra Dhopatkar

Published: 01/12/2024 8:26 a.m. EST

Last Update: 02/26/2024 7:26 a.m. EST

Edited by: Jennifer Bonilla

If you’re searching for JJ Gold Net 30 reviews to determine if it’s a good Net-30 account for your business, we’re here to help.

As a business owner looking to build business credit and diversify your product offerings, JJ Gold International might be the solution you’ve been searching for. In this detailed JJ Gold Net 30 review, we’ll explore the company’s unique features, pricing, advantages, and potential limitations, particularly focusing on its suitability for small business owners and new businesses.

Recommended: Sign-up for a JJ Gold Net 30 account to build business credit in 30 days.

Overview:

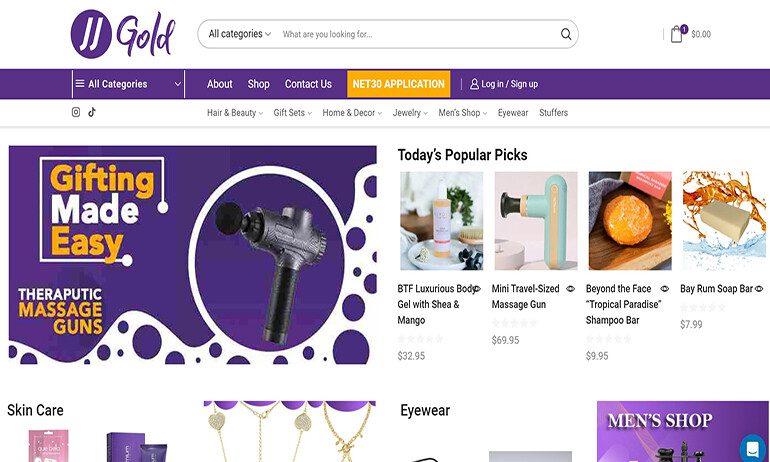

Imagine the opportunity to build business credit in 30 days by purchasing an array of products from jewelry to home decor, all while benefiting from a convenient net 30 account. JJ Gold International provides this, granting you 30 days to pay and a chance to report to business credit bureaus, making it an appealing net 30 vendor for new businesses.

Notable Features:

JJ Gold International is distinct for several reasons:

- Reports to Major Business Credit Bureaus: Their commitment to reporting to business credit bureaus like Dun & Bradstreet and Experian Business is crucial for enhancing your business credit score.

- Ideal for New Businesses: With minimal requirements and a business credit line accessible for businesses operational for at least 30 days, JJ Gold is perfect for new business ventures aiming to establish vendor credit.

- Wide Product Range: Over 1,000 products are available, catering to various interests and needs. This range, coupled with regular inventory updates, positions JJ Gold as a versatile net 30 vendor.

Pricing:

Consider these pricing aspects:

- Minimum Purchase Requirement: A $100 minimum purchase is needed for net 30 terms, with only 50% qualifying for these terms.

- $99 Annual Fee: A slightly higher than average annual fee for credit reporting.

Pros:

- Credit Reporting: Beneficial for business credit score enhancement.

- Accessible to New Businesses: Great for startups looking to build credit in 30 days.

- Diverse Product Selection: Over 1,000 different products available.

- Multiple Business Credit Bureaus: Improve your business credit reports with guaranteed tradelines reported monthly to D&B and Experian Business.

Cons:

- 50% Upfront Payment: May be challenging for some cash flows.

- Annual Fee: Higher compared to some competitors.

- Payment Term Transparency: Could be clearer.

Suitability:

JJ Gold Net 30 is exceptionally well-aligned for a broad spectrum of business needs, enhancing its suitability across various sectors:

- Businesses Aiming to Build Credit: For those striving to help your business build a solid credit foundation, JJ Gold Net 30 offers a strategic pathway. It’s a practical choice for those just starting to apply for credit or wishing to build up their business credit profiles.

- Enterprises Seeking Vendor Credit: JJ Gold Net 30 is a prime option for entities aiming to apply for vendor credit. This is particularly valuable for those who are exploring options like net 45 or net 60 terms, which are essential in managing cash flow and inventory.

- Businesses Using Diverse Credit Facilities: For organizations that use or are interested in Amazon business credit cards, business prime American Express cards, or similar products, JJ Gold Net 30 provides an additional avenue for managing business finances. It’s also a fit for those with business prime membership looking to diversify their credit sources.

- Businesses Seeking Reporting to Credit Agencies: With its ability to report to the business credit and major business credit reporting agencies such as Equifax and D&B, this program is crucial for businesses needing to maintain top business credit and ensure their business credit check reflects their financial responsibility.

- Startups and Established Businesses: Whether it’s a new business or an existing business, JJ Gold Net 30 is adaptable, offering free business credit advice and support. It’s suitable for companies that have been in business for at least 30 days and are looking to establish or strengthen their credit history.

By incorporating JJ Gold Net 30 into your business’s financial strategy, you can effectively navigate the complexities of credit management, from ensuring timely reports to Equifax to managing vendor reports efficiently. This program is not just about acquiring products with net 30 terms; it’s about building a stronger financial future for your business.

User Breakdown:

JJ Gold’s Net 30 service is a powerful tool for small business owners and existing businesses looking to enhance their business credit history. It caters to a wide range of users, from those seeking to build up their business with net 30 credit terms to established entities looking to leverage vendor lines of credit.

It’s especially useful for businesses in need of easy approval net 30 accounts, offering a straightforward credit application process that helps build positive business credit.

Customer Service:

JJ Gold prides itself on a customer service team that is not only responsive but also highly knowledgeable about business credit reporting and net-30 business accounts.

They provide valuable insights into how using their service can affect your credit score positively and assist with queries related to business and personal credit.

This support is particularly beneficial for businesses navigating credit terms, credit checks, and understanding the impact on major credit bureaus like Equifax Business.

User Testimonials:

In lieu of specific testimonials, general feedback indicates that users appreciate JJ Gold for its role in helping them establish business credit quickly.

Clients value the dual benefit of purchasing products while enhancing their business credit profile, particularly noting the ease with which JJ Gold integrates into their business plans.

Users also highlight the importance of JJ Gold in their journey of obtaining business loans, managing business accounts, and improving their standing with business credit agencies.

Reliability:

JJ Gold’s reliability stems from its consistent performance and adherence to net 30 payment terms. The company’s systematic credit reporting to agencies like D&B and Equifax Business ensures that their clients’ credit histories are accurately updated, which is critical for securing future lines of credit or small business loans. Additionally, the company’s focus on maintaining positive business credit for its users contributes to its reputation as a dependable net 30 vendor in the 30 business landscape.

A satisfied customer remarked, “JJ Gold has played a significant role in swiftly building our business credit.”

Summary:

JJ Gold International is a promising option for business owners wanting to build business credit while accessing a diverse product range. Its credit reporting feature and terms favorable to new businesses are highlights, though the 50% upfront requirement and $99 fee are considerations.

Final Verdict:

JJ Gold Net 30 is a strong candidate for entrepreneurs aiming to build business credit. Its benefits in credit reporting and accessibility are notable, but those seeking full transparency in payment terms might explore other options.

Explore JJ Gold’s offerings and consider applying for a net 30 account on their website. For longer payment terms, check their listings for net 60 and net 90 vendors.

How to Open a Net 30 Account with JJ Gold:

Opening a Net 30 account with JJ Gold is a pivotal move for business owners aiming to enhance their financial standing and creditworthiness.

This process not only helps in building a solid business credit card profile but also aids in managing trade credit effectively.

By obtaining Net-30 accounts to build business credit, you’re taking a significant step towards establishing a reliable payment history with credit reporting agencies, which is vital for increasing your credit limit in the future.

Additionally, this account can positively impact both your personal credit check and business credit scores. Here’s how you can start the process:

- Visit JJ Gold’s Website: Start your application process here.

- Check Eligibility: Ensure your business is US-based, over 30 days old, and has a clean history.

- Gather Information: Prepare your EIN and DUNS numbers.

- Minimum Purchase: Remember the $100 requirement, with 50% upfront.

- Annual Fee: Be ready for the $99 fee for credit reporting.

- Submit Application: Accurately complete the application on their website.

- Await Approval: Once approved, you’ll receive instructions on using your account.

Opening an account with JJ Gold is a strategic step towards building a robust business credit profile.

If you want to learn more about building business credit, in particular net-30 accounts, see our guide: How to Build Business Credit in 30 Days, and check out our extensive list of Net 30 vendors.

FAQs:

How can JJ Gold Net 30 help a new business build business credit?

JJ Gold Net 30 is designed to assist new businesses in establishing and building their business credit. By providing net-30 accounts to build business credit, it enables new enterprises to demonstrate creditworthiness through timely payments. This, in turn, helps in developing a solid business credit history, crucial for future financial endeavors.

What types of products does JJ Gold offer for businesses seeking to apply for vendor credit?

As a net 30 vendor, JJ Gold offers a diverse array of products suitable for businesses seeking to apply for vendor credit. Their offerings range from office supplies to electronics, providing businesses with essential items needed for operations while allowing them to manage their finances more effectively through vendor credit.

How does JJ Gold Net 30 contribute to a business’s financial strategy?

Incorporating JJ Gold Net 30 into your business plan can be a strategic financial move. It helps build up your business by providing trade credit, which can be critical in managing cash flow and inventory. Furthermore, timely payments through this account can enhance your company’s credit profile.

Can JJ Gold Net 30 improve my business credit card options?

Using JJ Gold Net 30 can positively influence your business credit card options. By consistently reporting your payment history to commercial credit agencies, it helps in building a stronger credit profile, which can lead to better credit card offers, higher credit limits, and potentially lower interest rates.

What are the benefits of choosing JJ Gold Net 30 over other credit cards?

Choosing JJ Gold Net 30 over traditional credit cards offers specific benefits, especially for businesses. It provides easy approval net 30 terms, which can be more flexible than standard credit cards, and helps in building business credit more effectively. Additionally, it offers a range of products that may not be available through typical credit card purchases.

How does JJ Gold Net 30 ensure timely reporting to credit bureaus?

JJ Gold Net 30 ensures timely reporting to business credit reporting agencies, such as D&B, which is vital for maintaining a positive credit history. This consistent reporting helps businesses keep their credit profiles up-to-date and accurate, reflecting their financial responsibility.

What is required to maintain a good standing with JJ Gold Net 30?

To maintain a good standing with JJ Gold Net 30, it is essential to ensure payments are due within 30 days. Consistent and timely payments are critical for keeping your account in good standing, which in turn positively affects your personal or business credit score. Additionally, maintaining a good personal credit score can also be beneficial in enhancing your business’s creditworthiness.

Chandra, founder of “Build Business Credit in 30 Days,” specializes in increasing business valuations by helping companies build strong business credit.